If I may beg your indulgence as the holiday looms… I decided to re-post (with audio this time), a popular piece from October of this year focusing on the Catch-22 of credit scores and the outsized role these made-up numbers have on our lives.

I’ll bet many of you are finishing your holiday shopping with a whirlwind of credit card purchases. If you are one of the small percentage of people world-wide who have enough cash on hand to pay your bill in full at the end of each billing cycle, then kudos to you! The rest of us will have to pay our credit cards’ near-usury interest rates for many month or even years to come. And as I explain below, the interest rate you pay is based on your credit-worthiness, which is typically determined by a three digit score assigned to you by credit reporting agencies like TransUnion, Equifax and Experian. Basically, if you have a high credit score number, you will pay a lower interest rate, a lower number, a higher rate. But here’s the catch: only those who don’t really need the whopping amount of credit extended to them at low interest rates, get those low interest rates and access to money…and only because they already have money.

I also want to take this time to thank you for reading and listening to my posts, and to wish all a fun, safe holiday for those of you who celebrate, and a great New Year! My planned schedule is to post a shortened Sunday Evening Reads this coming Sunday as usual, and then do an end of the year wrap-up next Thursday, right before we burst into 2022.

Oh, if you want to use that credit card one last time and still are in need of a gift, why not give a subscription to Crime and Punishment? The credit card companies will thank you and so will I!

“There was only one catch and that was Catch-22, …”

Joseph Heller, “Catch-22”

Heller’s insightful protagonist, Captain Yossarian, was right—there was only one, tragic “catch” to the bombadiers’ predicament in the novel Catch-22. But the “Catch-22” millions of people are caught in today, by the credit score industry’s circular logic, runs a close second.

Others have written about the “Catch-22” of credit scores, but they point out a different “catch” than I do. For example, young borrowers have not been able to build up a positive credit history, because, well, they’re too young to have paid consistently on car loans and mortgage loans or held a job for a number of years, all of which are usually needed to get a good credit score and therefore decent credit deals, meaning moderate to low interest rates. Additionally, years of on-time rent and utility payments do not show up on a traditional credit report, which is translated into a credit score, which in turn, is used by lenders to make credit viability decisions. As this article from The Guardian points out, an unfortunate number of millennials are turning to payday loans to borrow money, which actually hurt a credit score in both the short and long run, in addition to the usury interest rates that are a given with such loans.

I was heartened to read that President Biden is considering harnessing the power of the Consumer Financial Protection Bureau to make the credit score model more fair by including those same variables, rent and utility payments, to allow lower income folks to establish good credit. The President is also considering establishing a public entity, within the CFPB, to create and manage this updated scoring model: “Almost half of consumers in low-income neighborhoods do not qualify for traditional loans under current methods, according to CFPB research. A public entity utilizing nontraditional data could change that, experts say.”

But my “catch” involves the entire credit score system.

History

First, let’s take a fun look at the history of the credit score. Did you realize that there are real peoples’ names behind those acronyms? Credit scores were first created in the 1950’s by Bill Fair and Earl Issac, statisticians who made what turned out to be fairly accurate predictions of a person’s credit-worthiness. Their company, Fair, Issac and Company eventually morphed into FICO, today’s behemoth that generates our FICO Scores from credit reports maintained by the three major credit reporting agencies: TransUnion, Equifax and Experian. Credit scores didn’t vault into regular use until the 1970’s, and the “modern iteration of the FICO score…was not introduced until 1989.”

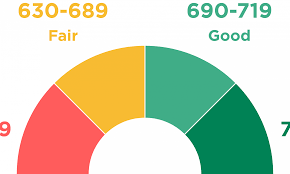

Note the difference between a credit report, which is a compilation of financial information collected on a particular person (that’s all of us), and credit scores, which are the three-digit numbers that are generated through an algorithmic calculation of the information contained in those credit reports. The three credit bureaus are private businesses and consider the algorithms that generate our individual scores as proprietary, so there isn’t full transparency about how those numbers are generated.

Why the change from a personal and subjective lending experience to an impersonal and more objective one? There are some pretty good reasons. When use of credit cards started to take off in the early 1970’s, lenders couldn’t keep up with the demands of individually determining the credit worthiness of so many. But it was also a question of fairness: the use of credit scores removed the subjective nature of lending — what did the typically white male in the bank think of the way you dressed, did he stereotype your credit worthiness or lack thereof based on your race, did you have a less than stellar reputation in the community that he could use to deny you a credit card or a mortgage? The credit score supposedly removed those subjective reasons, but added other criteria to create a circular logic that those without money cannot escape.

The Cruel Irony

If credit scores, which have grown to monster-sized proportions in determining a person’s choices in life, like the ability to get credit, including a mortgage, credit score checks to get a job or rent an apartment, didn’t present such a cruel scenario for the average American, it would be funny.

Check out these “tips” to improve your credit score that appear at the end of my credit score monitoring page, and probably yours, too. I’ve shortened the list to just the essentials:

Quick tips to get your credit in tip-top shape:

Keep credit card balances low: Try not to max out your credit cards. Better yet, pay the balance in full each month if you can.

Pay down debt: Create a plan to completely pay off an account.

Pay off past due accounts: Contact your creditors to make arrangements to pay off any debts that have gone to collections.

Make extra payments: Consider making extra payments on your credit card accounts or loans each month, as long as there are no penalties for doing so.

Do you see that each of these “tips” requires a person to have that elusive substance that those in poverty, the middle class, and even those with more substantial incomes simply don’t have? It’s called cash.

If 40% of Americans don’t have enough cash on hand to cover a $400 emergency expense, how are they capable of following this advice? They aren’t. That’s why at least 108 million consumers in the U.S. have no credit score or a low credit score—that’s close to a third of our country’s population. I’ve often wondered, given the statistics I just quoted, whether those who wrote these “tips” for paying down debt and increasing a credit score are embarrassed. Imagine someone who has a serious illness and had to charge their medical debt on credit cards, or someone who got fired or laid off from their job and can barely make the minimum payments on their credit cards, let alone pay extra, as their debt rises daily? It’s the “doing of an impossible thing” that the law abhors, and akin to “pulling yourself up by your bootstraps”.

And to add insult to real injury, consumers also are advised to take out credit, but don’t use too much of it or your credit score will go down, but know that your score will also go down each time you apply for credit, regardless of whether you are approved; to pay all of your bills on time or your credit score will again take a major dip; that if your credit score is characterized as “low to good” you will pay much higher interest rates on any credit you do get, thus again, punishing you for not having cash, and don’t ever try to settle debt or heaven forbid, declare bankruptcy, or your score will nosedive for up to a decade.

I’m not arguing here against the use of credit cards or of even checking your credit reports and scores to make sure there are no surprise charges from a stranger basking in the tropical sun on your dime. But shouldn’t we be aware that millions of our fellow Americans can’t control these three digit numbers that have an outsized influence on our financial lives, who can’t escape from the even greater poverty induced by debt and the financial punishment from having a low credit score…all because of a lack of cash?

Captain Yossarian would be proud.

I’d love it if you would share your thoughts in the comment section below.

And if you like what you just read, why not share it with friends and enemies, alike?

Additional Reading

© 2021 Joan DeMartin. See privacy, terms and information collection notice

Publish on SubstackCrime and Punishment: Why the Poor Stay Poor In America is on Substack – the place for independent writing

Credit Scores: