“Misclassification of workers as independent contractors is a pervasive and extensive problem in the United States. According to a report commissioned by the U.S. Department of Labor, as many as 30% of employers, and perhaps more, have misclassified some workers, affecting millions of workers, disproportionately workers of color.” Economic Policy Institute, 2021.

The term “misclassification” sounds too much like a euphemism considering what happens to workers when they are wrongly classified as independent contractors, or something less than a full-time or part-time employee. And the word seems to imply that the choice to misclassify is a mistake, when in fact, it is often a purposeful decision made by a company or educational institution to save money.

The Department of Labor (USDOL) estimates about 36% of all workers in 2020 were independent contractors or “gig” workers, totaling approximately 59 million Americans. These numbers have increased since then, and are expected to increase even further in the next few years.1 However, a good percentage of these workers have been misclassified and should be correctly designated as employees.

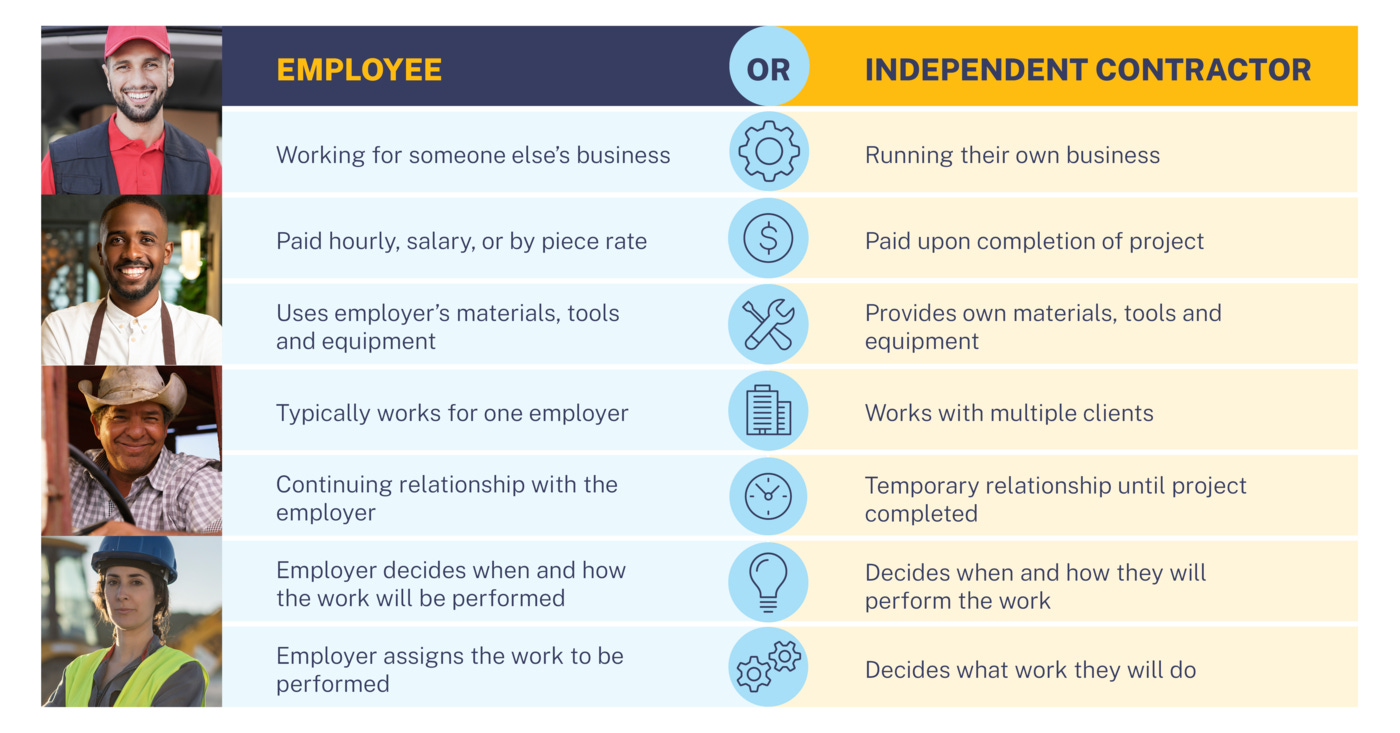

The Department of Labor defines two types of worker classifications: employee (full-time and part-time) and independent contractor, and from their respective descriptions, it appears at first glance to be a stark contrast. But it’s difficult to tell the difference in practice because there are no straight forward definitions for each classification, it is rather a list of likely “attributes” for one classification versus the other. Here’s a handy chart provided by the U.S. Department of Labor, Wage and Hour Division, that lists these attributes for each category.

It’s important to understand that the differences between the classifications are substantive, like how much control an employer has over how and where you work. An employer can slap any label it wants on its business operations, but it’s the substance that matters. I’ll share an example from my lawyer days at the Ohio EPA: some employees would stamp agency documents with the word “Confidential”, in bright red, no less, thinking (or at least hoping) that the label would actually make those documents confidential, and I would not disclose them with a public information request. Of course, it is the substantive content of the document that makes it confidential or a public record.

The Economic Policy Institute and the USDOL decry the impacts of misclassification:

Misclassification denies employees access to critical benefits and protections they are entitled to – overtime, the minimum wage, family and medical leave and, in some cases, safe workplaces. It generates substantial losses to the U.S. Treasury and the Social Security and Medicare funds, as well as to state unemployment insurance and workers’ compensation funds. It cheats every taxpayer. It undermines the entire economy.2

In other words, employers who classify all or some of its’ workers as independent contractors, whether mistakenly or purposefully, cheat the worker out of much-needed benefits (including pay raises and bonuses), job protections required for employees, and cheats the government out of money by failing to pay the treasury Medicare, Social Security and unemployment benefits on behalf of those workers. The only one who “wins” in this situation are the employers because they’re saving money, at least in the short term. But if you care about current and retired workers and our economy as a whole, you’ll believe, like I do, there are no winners under this misclassification scheme.

Until Covid and the Cares Act, Independent Contractors also did not qualify to receive unemployment benefits. Thankfully, when our economy almost completely shut down, Congress recognized the large number of gig workers would need unemployment benefits too, and the Cares Act extended that crucial benefit to millions of Independent Contractors, albeit temporarily — the Cares Act expired in September 2021.

Unfortunately, it gets more complicated than just two, USDOL worker classifications. The college where I have worked as a part-time writing tutor since 2016, for example, classifies its tutors as “part-time casual employees”, which is an unofficial designation used fairly often by educational institutions. The difference here is between the terms “part-time” and “part-time casual”, not between employee or independent contractor.

The definition of “casual” labor, according to Cornell Law School’s Legal Information Institute, is not found in any state statutes, but rather gleaned from court cases that have ruled on the issue:

…a term of art used to refer to work that does not further the business of the employer, typically done on a one-time or very sporadic basis… employment may be considered casual in character if the person is employed only occasionally, at comparatively long and irregular intervals, for limited and temporary purposes, or if the hiring in each instance is a matter of special engagement.

The tutoring where I work is in no way sporadic—I am assigned specific hours every semester, and helping the college’s students with their course work certainly furthers the business of the college. Other than during Covid, I use the college’s facilities and tools to tutor, I am paid hourly, and the college deducts all taxes, including Medicare and retirement from my pay. It was only in 2021, after I had worked there 5 years, that the school gave the tutors a small raise, and inexplicably, sick leave, which alone, negates the “casual” designation. If we have been misclassified, I and my fellow tutors have missed out on years of raises, periodic bonuses, paid holidays and other paid time off.

And what do you do to address a situation like this, particularly if you are not a member of a union, without risking some form of retaliation?

One way is to report your situation to your state’s department of labor. Here’s the state lookup tool with contact information: https://www.dol.gov/agencies/whd/state/contacts

Do you think misclassification is a big issue for today’s individual workers, retired workers and our economy as a whole? Please share your thoughts in the Comment Section below.

And…

I ask you to join me on our journey to understand the “why” behind the facts, so together we can help find solutions to our most pressing economic, racial and environmental issues and push to right the wrongs of our system. Each of us can thrive in this country, if we don’t allow ourselves to be beaten down by the very system we’re trying to make good in. One of the best ways to do this is to become an active member of your community and a participating citizen in our larger community.

And speaking of communities, you can also become a participating member of the Crime and Punishment community by signing up right now for a free or paid subscription. Thanks in advance for your support!

Note: This source uses USDOL statistics: https://a-vlaw.com/blog/employment-law/are-gig-workers-considered-independent-contractors-or-employees/

Misclassification Of Employees Is Rampant